How we do it?

- This task involves Verification of Property/ Holding Data & Collection of Relevant Information of each Property through:

- Contact Survey

- Generation of Database

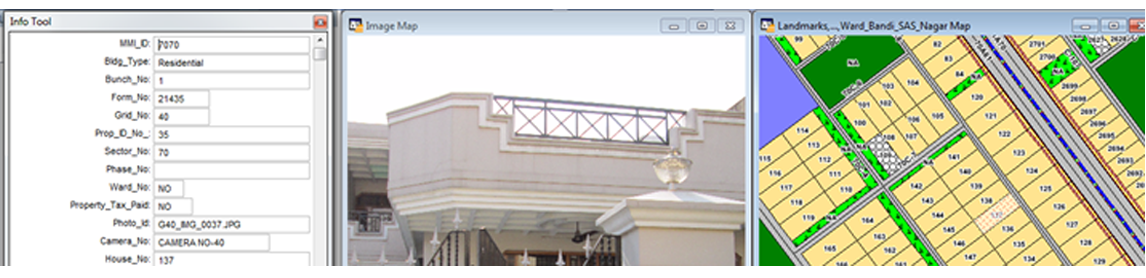

- Capturing Digital Photograph of each Property or Holding

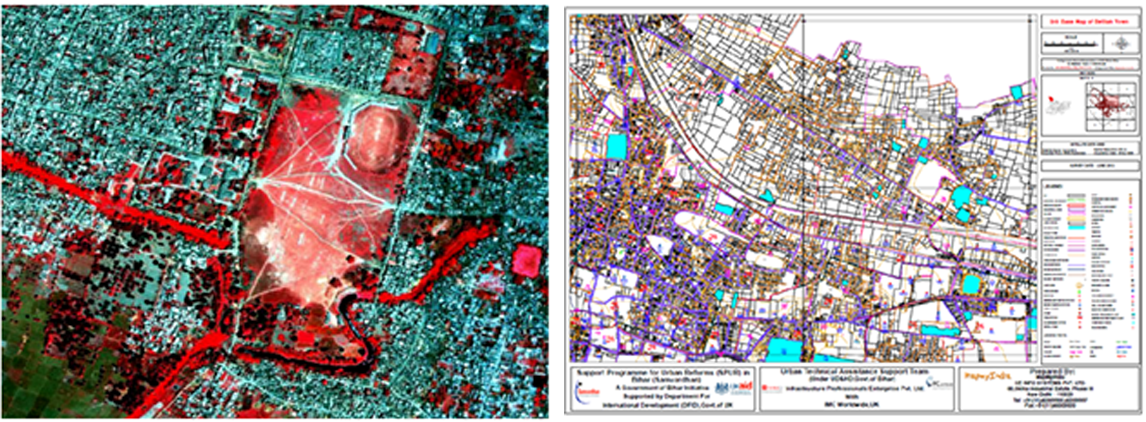

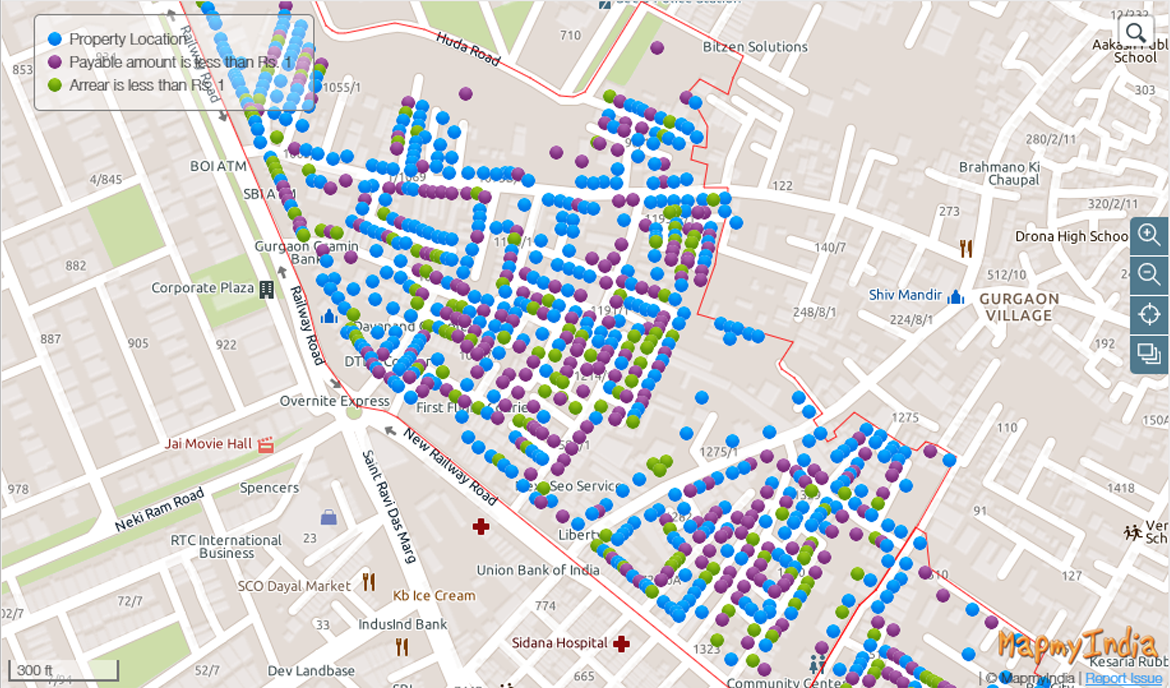

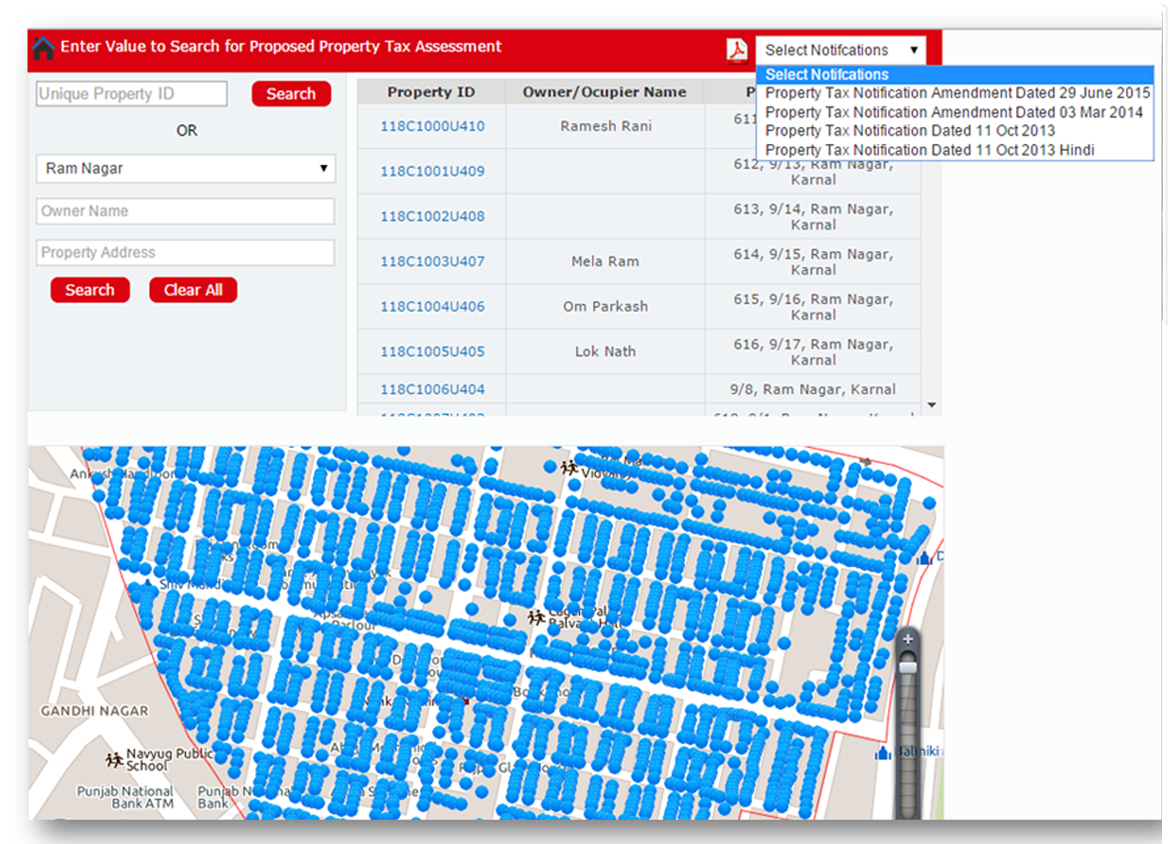

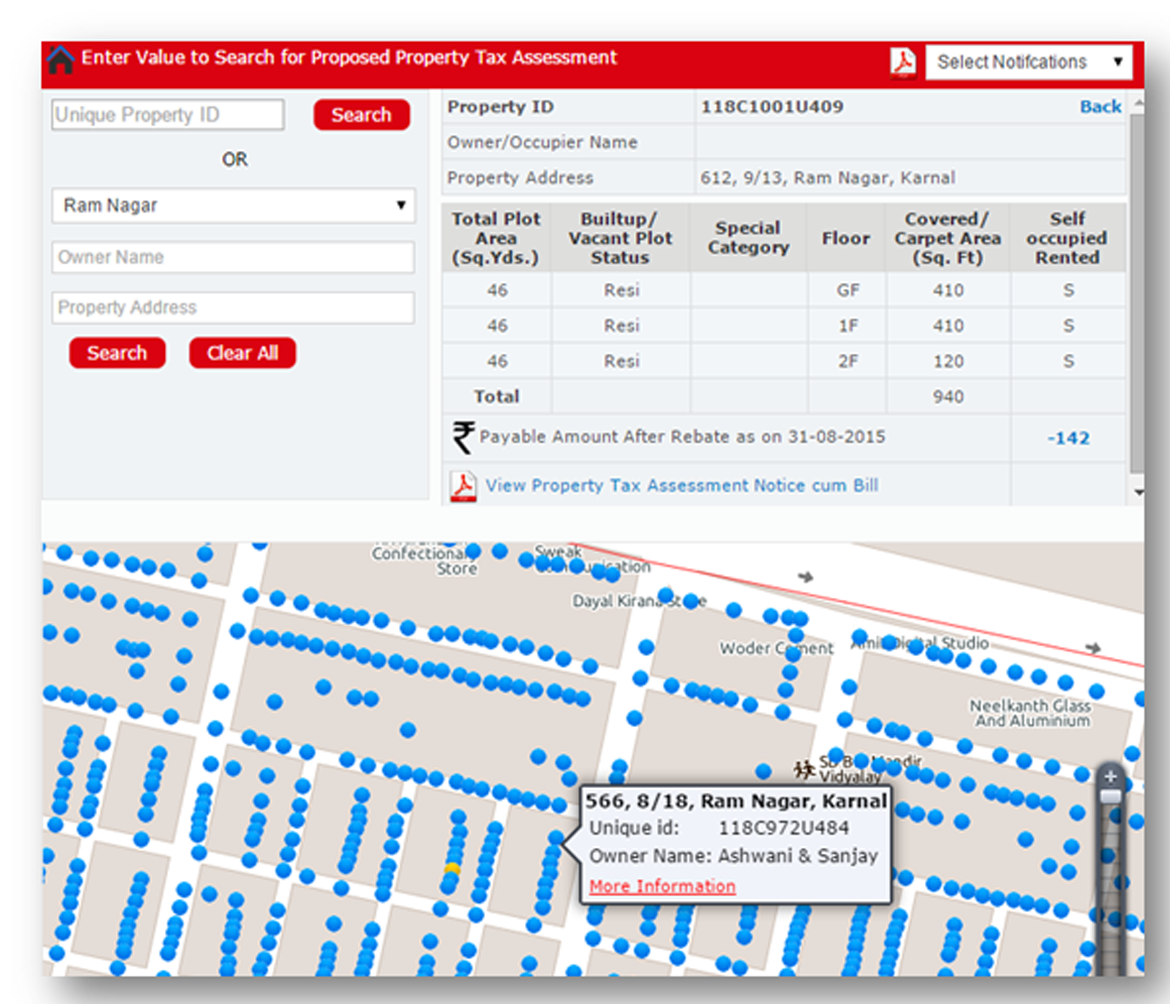

- Database & Digital Photograph to be linked with GIS Base Map

- The ground survey includes capturing the type of property and making sketches of the structures, where needed, on top of the base map. The ground survey also locates specific household parcels , assigns them unique identification numbers (IDs) and notes these down in the field book.

- This survey shall ensure that property parcels are properly collected and the data of the respective property is filled in the field book.

- The field collected data will then be updated on the Digital GIS Base Map as a “Property Layer” with the demarcations of Property, its associated attribute and unique identification number. Existing ULB data is also an attribute in the property mapping, for comparative analysis and further assessment. Lastly, final ground validation of Property Maps will take place and records will be updated.

Creation of Comprehensive Database:

- Creation of comprehensive UID centred Database linked with GIS Base Map including information of newly collected data, existing data, property tax records, assessment details etc.